Home Equity Loan Guide: How to Apply and Certify

Home Equity Loan Guide: How to Apply and Certify

Blog Article

Secret Aspects to Take Into Consideration When Requesting an Equity Finance

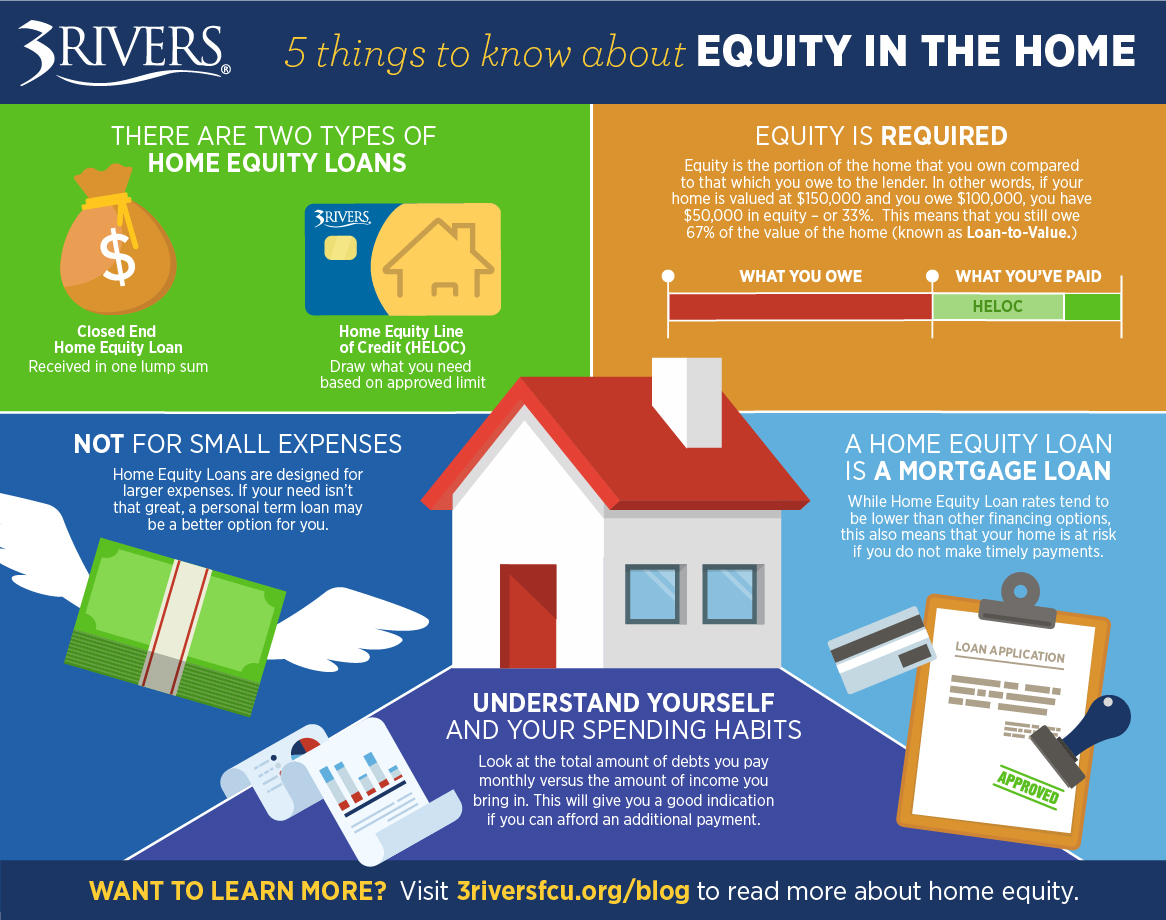

When considering using for an equity funding, it is crucial to navigate via numerous crucial variables that can substantially impact your monetary well-being. Understanding the types of equity financings readily available, assessing your qualification based on monetary aspects, and meticulously analyzing the loan-to-value proportion are vital preliminary actions.

Kinds Of Equity Lendings

Numerous banks provide an array of equity lendings tailored to satisfy diverse borrowing demands. One typical kind is the traditional home equity financing, where property owners can obtain a round figure at a fixed interest rate, utilizing their home as security. This kind of finance is suitable for those that require a large amount of money upfront for a specific function, such as home improvements or financial debt consolidation.

Another preferred choice is the home equity line of credit scores (HELOC), which operates extra like a charge card with a rotating debt limit based on the equity in the home. Customers can draw funds as needed, approximately a specific limit, and just pay passion on the quantity made use of. Equity Loans. HELOCs appropriate for ongoing expenditures or tasks with unsure expenses

Furthermore, there are cash-out refinances, where house owners can refinance their existing home mortgage for a greater amount than what they obtain the distinction and owe in money - Alpine Credits. This kind of equity financing is useful for those looking to make use of reduced rates of interest or gain access to a large sum of cash without an extra month-to-month settlement

Equity Car Loan Eligibility Elements

When considering eligibility for an equity financing, financial establishments normally evaluate aspects such as the applicant's credit scores rating, income security, and existing financial debt obligations. Earnings security is another essential variable, showing the debtor's capacity to make normal finance repayments. By carefully evaluating these aspects, financial establishments can establish the applicant's eligibility for an equity lending and develop suitable loan terms.

Loan-to-Value Proportion Factors To Consider

A reduced LTV proportion suggests less risk for the loan provider, as the customer has more equity in the building. Lenders generally prefer reduced LTV proportions, as they provide a higher pillow in case the debtor defaults on the financing. A greater LTV ratio, on the various other hand, suggests a riskier investment for the loan provider, as the consumer has much less equity in the residential or commercial property. This might lead to the lender enforcing higher interest rates or stricter terms on the car loan to minimize the increased risk. Debtors should aim to keep their LTV ratio as low as possible to enhance their opportunities of authorization and protect a lot more desirable car loan terms.

Rate Of Interest and Charges Comparison

Upon examining passion prices and costs, debtors can make educated decisions regarding equity lendings. Interest prices can significantly impact the overall price of the lending, influencing month-to-month repayments and the complete amount paid off over the funding term.

Apart from passion prices, debtors need to additionally take into consideration the various charges related to equity financings - Alpine Credits Home Equity Loans. These costs can consist of source charges, appraisal fees, closing prices, and early repayment fines. Origination charges are charged by the loan provider for refining the lending, while evaluation costs cover the price of assessing the property's value. Closing prices encompass different costs associated with settling the loan arrangement. If the customer pays off the finance early., early repayment charges may apply.

Repayment Terms Evaluation

Effective assessment of payment terms is crucial for borrowers seeking an equity financing as it straight influences the loan's cost and financial end results. The financing term refers to the size of time over which the debtor is anticipated to pay off the equity finance. By extensively reviewing payment terms, customers can make informed decisions that align with their economic objectives and ensure successful finance management.

Verdict

In conclusion, when obtaining an equity finance, it is necessary to take into consideration the kind of lending available, eligibility elements, loan-to-value proportion, rate of interest and charges, and payment terms - Alpine Credits Equity Loans. By thoroughly evaluating these crucial elements, borrowers can make educated decisions that align with their financial goals and scenarios. It is crucial to thoroughly research study and compare options to make certain the ideal feasible result when looking for an equity funding.

By meticulously assessing these variables, monetary organizations can identify the applicant's eligibility for an equity finance and establish suitable loan terms. - Home Equity Loans

Passion rates can substantially impact the general expense of the finance, influencing month-to-month settlements and the total quantity paid this hyperlink back over the finance term.Efficient analysis of repayment terms is important for debtors seeking an equity funding as it straight influences the lending's cost and economic outcomes. The lending term refers to the length of time over which the debtor is anticipated to pay back the equity finance.In conclusion, when using for an equity car loan, it is vital to think about the kind of loan offered, eligibility variables, loan-to-value ratio, passion prices and fees, and repayment terms.

Report this page